Disclaimer: The information in this blog is accurate as of its publication date. Any updates after that date are not reflected here.

Are you thinking about starting a company in the UK? It is still a smart move for international founders and business owners. The UK offers a stable economy, clear rules for business, deep pools of capital, modern infrastructure, and access to skilled talent. Investment into UK startups stayed strong in 2024, which shows confidence in the market. If you are wondering how to open a business in UK, this guide walks you through who can set up, how the local business culture works, the main legal structures, the step-by-step setup in 2025, and the visa routes to consider. You will also find practical resources to help you tackle the business challenges and take the next step.

Table of Contents

What is the Business Culture in the UK?

If you are one of those people who are wondering about how business is conducted in the UK, one way to look at it is, in most offices, smart casual has taken the place of rigid formality; remote and hybrid work are prevalent; and results are highly valued. Professionalism, punctuality, and clear communication still matter. For international entrepreneurs, this culture translates into quicker decision cycles, openness to innovation, and a rich network of accelerators, universities, and specialist hubs that can help you test and scale ideas.

A Y & J Case note: Several of our clients found that weekly check-ins, crisp written updates, and clear meeting agendas shortened vendor onboarding times and improved investor confidence during early traction.

Who Can Start a Business in the United Kingdom?

In short, anyone can set up a business in the UK if they meet legal and immigration requirements. Most overseas entrepreneurs will need a suitable visa and must meet the relevant eligibility rules, including suitability and good character. A Y & J Solicitors provides visa strategy and application support so you meet each requirement the first time. Common pathways include:

- Innovator Founder Visa: For new, innovative, viable, and scalable ventures with endorsement.

- Global Business Mobility: UK Expansion Worker for opening a UK branch or subsidiary of an existing overseas business.

- Self-Sponsorship Route: Using your existing UK company/your acquired UK company and Sponsor Licence to hire yourself into a genuine role under the Skilled Worker route.

Legal Structures: How to Set Up a Business UK

Choosing the right legal structure is one of your first strategic decisions. Use the quick comparison below, then speak with an accountant or company formation specialist to confirm the best fit.

Quick comparison chart

| Structure | Liability | Setup and admin | Typical use case |

| Sole Trader | Personal liability | Simple setup, simple tax | Freelancers, consultants testing a concept |

| Partnership | Shared personal liability | Moderate admin | Professional partnerships with shared control |

| Limited Partnership | General partner unlimited, limited partner protected | Moderate | Investment or projects with passive capital |

| LLP | Limited liability for partners | Moderate | Professional services with shared management |

| Private Limited Company (Ltd) | Limited liability | Company admin, separate entity | Growth-oriented startups, liability protection |

| Public Limited Company (PLC) | Limited liability, public reporting | Complex | Larger companies raising public capital |

| Unlimited Company | Unlimited liability | Niche | Specific privacy or financing goals |

| Social Enterprise | Mission-driven | Varies | Impact ventures reinvesting profits |

| Unincorporated Association | Often unregistered | Light | Clubs, societies, voluntary groups |

| Offshore Company | Incorporated outside the UK | Varies | Cross-border structures with UK activity |

Note:

If setting up from scratch feels time consuming and too much of a hassle, you can acquire an actively trading UK company instead.On the Self-Sponsorship path, we collaborate closely with StratExec Capital Ltd (SCL). While we oversee immigration compliance, sponsor license preparation, and visa filings, SCL manages the business acquisition. This alignment may result in settlement and helps you obtain a Skilled Worker visa so you can start working in the UK right away.

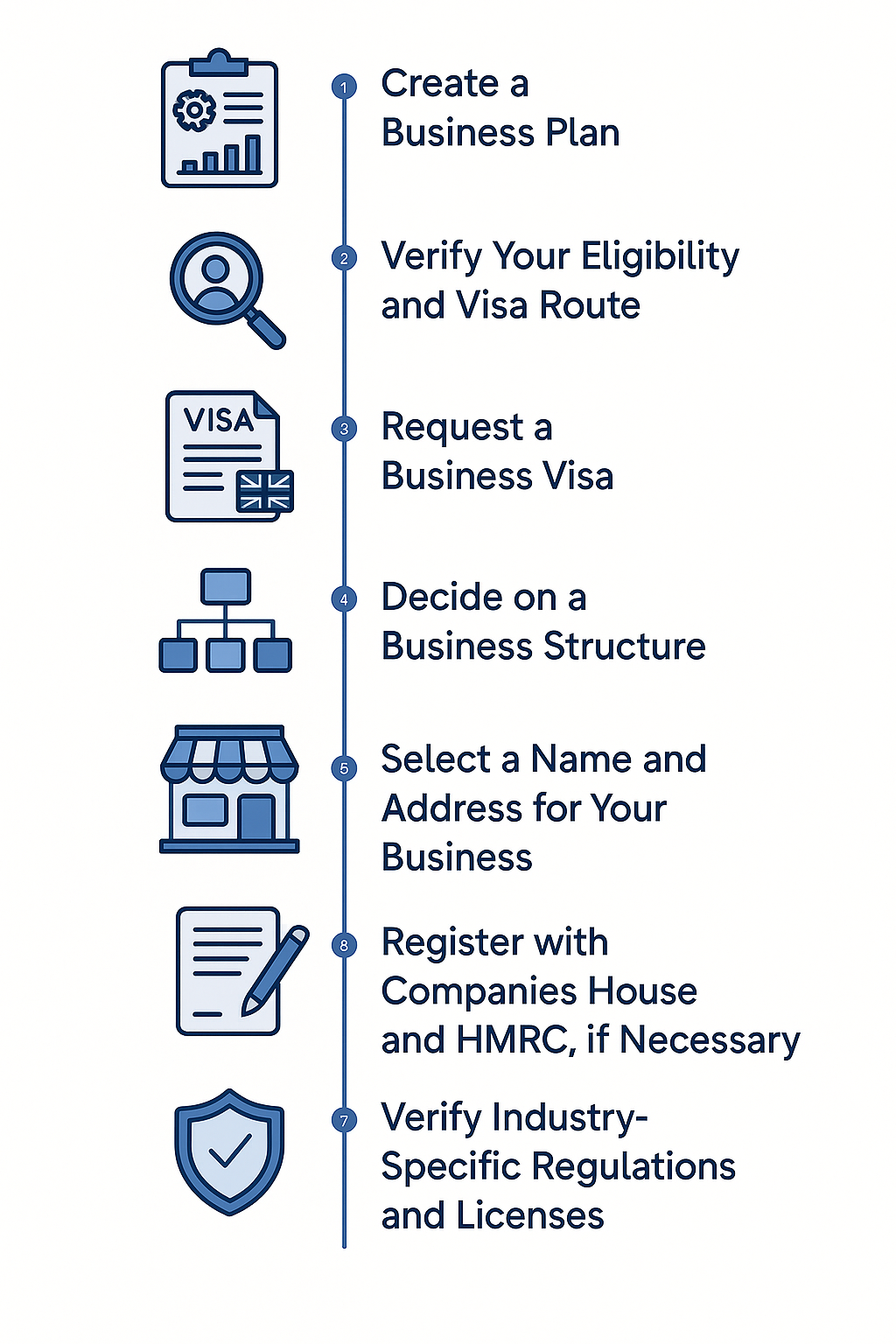

How to Open a Business in UK as an Expat: Step By Step

1. Create a Business Plan

Describe the market, forecast, model, and milestones. A well-thought-out plan boosts visa applications and supports funding.

2. Verify Your Eligibility and Visa Route

Verify that you meet the requirements for a visa at this early stage. The best course of action and the supporting documentation you’ll require are advised by A Y & J Solicitors.

3. Request a Business Visa

The application procedure and document checklist can be handled by your legal team.

4. Decide on a Business Structure

Verify the administrative, tax, and liability ramifications with your advisor.

5. Select a Name and Address for Your Business

Get a registered address and choose a name that complies. For your statutory address and first correspondence, if you are not yet in the UK, think about using a trustworthy virtual office service.

6. Register with Companies House and HMRC, if Necessary

HMRC is where sole traders register for taxes. Limited companies handle PAYE, VAT, and corporation tax as necessary after registering with Companies House.

7. Verify Industry-Specific Regulations and Licenses

Certain activities require certifications, approvals, or extra supervision.

Considering a charitable or non-profit focus? It might be necessary for you to register with the Charity Commission and adhere to specific reporting guidelines.

How to Obtain a Business Visa in the UK?

The right path for a business visaUK depends on your goals and how big your business is right now. Most of the time, people apply online. The amount of time it takes to process a case depends on the route and the number of cases. A Y & J Solicitors handles checking eligibility, paperwork, and the application process.

Innovator Founder Visa

For founders who want to build a business that is endorsed, new, viable, and scalable. The steps are:

- Draft a credible business plan

- Get approval from a recognised endorsing body

- Fill out the application online and pay the fee

- Give proof of identity and complete identity checks

Indicative timeline: Many applicants plan for several weeks between getting an endorsement and making a decision, depending on how busy the Home Office is.

Self-Sponsorship Route (Skilled Worker via your own company)

For entrepreneurs who will operate a UK company and take a genuine, skilled role.

- Existing/ Acquire an active trading UK company

- Apply for a Sponsor Licence for that company

- Issue a Certificate of Sponsorship for your role

- Apply for the Skilled Worker visa, pay the application fee and the Immigration Health Surcharge

- Give documents and do full identity checks

Why founders choose this: They can control their settlement path, see a clear path to growth, and make sure that immigration is in line with business growth.

Global Business Mobility: UK Expansion Worker

For businesses that are already established in other countries and want to open a branch or subsidiary in the UK.

- Get a Certificate of Sponsorship from the UK business

- Fill out an online application, pay the fee, and the Immigration Health Surcharge

- Provide documents and complete identity checks

Tip for Planning: Make sure your UK market entry plan, headcount, and sponsorship strategy all work together so that growth and compliance happen at the same time.

Administering Your Business in the UK

1. Business Banking

Set up a separate business account for income and costs. A lot of providers now let you check your identity from a distance, but you may still need to do it in person.

2. Taxation

Know what your corporation tax, VAT, and payroll duties are. Sign up with HMRC and write down the dates for filing.

3. Business insurance

Think about employer’s liability, public liability, and professional indemnity, depending on your model.

4. Employing staff

You have four weeks to register for PAYE after hiring someone. Follow the rules about right to work, wages, and work hours when you write contracts.

5. Tools that save time

Founders often use cloud accounting, payroll automation, receipt capture, and task trackers to make sure that filings and audits are done on time.

How Much Does it Cost to Open a Business in UK?

If you choose Self-Sponsorship, a typical first-year budget includes:

- Company registration, about £50

- Sponsor Licence fee, £574 for SMEs and £1579 for large enterprises

- Skilled Worker visa fee, about £769 to £1,751 depending on duration

- Immigration Health Surcharge, about £1,035 per year

- Legal support for Self-Sponsorship, plan for £18000 + VAT

- Domain and registered-office services, about £50 to £100

Budget planning: Total estimated cost for Self-Sponsorship (if you have an existing UK company/ you have acquired a UK company), is £18000 + VAT. It covers legal and Home Office items listed above. Add working capital for salaries, space, software, marketing, and a contingency reserve.

Support and Resources for Entrepreneurs

There is no shortage of credible help in the UK. Useful starting points include:

- GOV.UK for company setup, visas, and compliance guidance

- HM Revenue and Customs (HMRC) for registrations and tax rules

- Companies House for incorporations and filings

- British Chambers of Commerce for local networks

- British Business Bank for finance information

- The King’s Entrepreneurs Trust for early-stage support

FAQs on How to Open a Business in UK

1. Can I Start a Business if I am Not a UK Citizen?

Yes, provided you meet company law and have the correct immigration status.

2. Do I Need a UK Address to Set Up?

Yes, every company needs a registered office. A reputable virtual office can meet this requirement initially.

3. What is the Innovator Founder Visa and Do I Qualify?

It suits innovative, viable, scalable businesses with endorsement. An assessment will check idea strength, traction, and founder profile.

4. Do I Need a Visa to Run a Business From the UK?

Most overseas founders will need an appropriate visa unless they already hold valid UK status.

5. How Long Does Registration Take?

Companies House incorporations can be quick when documents are in order. Visa timelines vary by route and caseload.

6. How Much Should I Budget to Set up a Business in the UK?

Plan for the items listed above, then add working capital for your first 12 months. You should ideally set aside £150000+

7. What Insurance Do I Need?

At minimum, review employer’s liability if you hire staff, plus public liability and professional indemnity where relevant.

8. What Happens if I Miss a Tax Deadline?

You may face penalties or interest. Use calendar reminders and automation to avoid this.

9. How Do I Obtain Funding in the UK?

Explore bank finance, angel networks, venture capital, and grant schemes listed on British Business Bank and local growth hubs.

Final Words

Starting in the UK takes planning and good governance, but the payoff is strong for well-prepared entrepreneurs. By understanding culture, choosing the right structure, and securing the correct visa route, you can build confidently in a vibrant market. If you are mapping how to set up a business uk, align legal, tax, and hiring plans from day one.

Ready to start your business and make your move to the UK? Talk to A Y & J Solicitors for a free consultation on legal aspects. Our team has supported thousands of immigration journeys, including hundreds of Self-Sponsorship cases with a strong success rate. When you work with us, you receive clear advice, careful documentation, and support at every step.